-

Jun 30, 2017 Paying extra on a mortgage saves time, money

Published 30 June 2017

LAS CRUCES – With lots of new home sales come lots of new mortgages. And with each of those new mortgages come lots of monthly payments – 360 in the case of a typical 30-year loan. Each of those monthly payments is made up of multiple components such as principal and interest, reserves for taxes and insurance, and in some cases, mortgage insurance.

A buyer who takes out a new 30-year mortgage of $150,000 at 4 percent interest will have a monthly payment that includes a principal and interest component of $716.20. Pay that amount 360 months in a row and the loan is paid in full. Pay a little more than that amount each month and two things happen; the amount of the interest paid is significantly reduced and the amount of time it takes to pay off the loan is dramatically shortened. Here’s how it works.

Upon making his or her very first payment of $716.12, a buyer will see $500 of the total go to pay the first month’s interest. The remaining $216.12 goes towards paying off the loan. With each subsequent payment, the principal portion increases by two or three bucks, while the amount of interest decreases by an equal amount. By the time the 360th payment of is made, just $2.38 goes towards the interest.

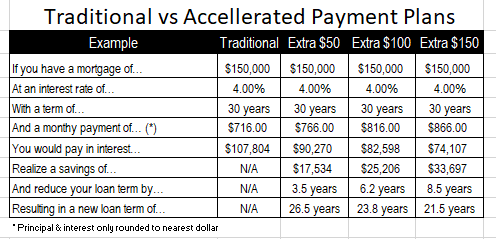

The key to saving time and money in the long run is to begin attacking the mortgage balance from day one. The whole idea is to reduce the amount of mortgage interest paid by accelerating the reduction of the principal portion of the loan. As the accompanying chart reveals, the amount of interest paid and time needed to retire the mortgage decline in direct relation to the number of extra dollars paid towards the loan balance each month.

Adding an extra $50 per month to the monthly payment in our $150,000 scenario saves $17,538 in interest and knocks 3.5 years off the original 30-year term. Increase the additional payment to $100 per month and the savings rise to $25,206 and 6.2 years, respectively. Go wild and pump up the payment by an additional $150 and voila, the buyer pays $33,697 less interest and retires the loan 8.5 years ahead of schedule. Some buyers opt to use their income tax refund or yearly employment bonus to make one large extra principal payment each year in place of a monthly contribution. Some do both.

Paying an extra $100 each month on a loan is like investing $100 each month in some sort of investment vehicle. Since mortgage rates are always higher than savings rates, a borrower would realize a better return by paying down a guaranteed 4 percent mortgage than he or she would by depositing the money into a smaller rate-of-return savings account. The downside of such a choice is that the savings account is liquid, meaning that the money is easily accessible. The money that’s paid on the loan becomes home equity, which is more difficult, costly and time consuming to access.

It’s important that borrowers check the terms of their mortgage to make sure they aren’t charged a prepayment penalty when adding additional principal payments to their loans. Most conventional, FHA and VA mortgages are typically penalty-free and allow additional payments at any time.

Buyers who have made regular payments for a number of years, especially if their mortgage interest rates are in the 5 to 7 percent range, will realize a greater rate of return. They can begin making additional payments whenever the urge strikes, especially if they don’t have a better use for the money. The effect won’t be as dramatic, but the savings of both time and dollars could still accelerate the date of that mortgage-burning party by a fair number of months or years.

See you at closing!

Gary Sandler is a full-time Realtor and president of Gary Sandler Inc., Realtors in Las Cruces. He can be reached at 575-642-2292 or Gary@GarySandler.com

About author

-

-

About Author

Gary Sandler

-

© 2022 Gary Sandler - Website Developed by: Digital Solutions