-

Published 23 February 2018

LAS CRUCES – It was just a few weeks ago that I shared the story of a young school teacher who was struggling to decide whether to buy an easy-to-afford home today or wait to purchase a more expensive home a couple of years from now when her income is higher. By choosing the latter, she was betting that her increases in pay over the 24-month period would outpace the rise in home prices and mortgage interest rates that were looming on the horizon.

I hope she hedged her bet, because her plan is already falling apart. Since making that fateful decision just over a month ago, the value of the average Las Cruces-area home increased by just over $1,300 and mortgage interest rates have risen by just under one- half percent, putting her solidly behind the curve.

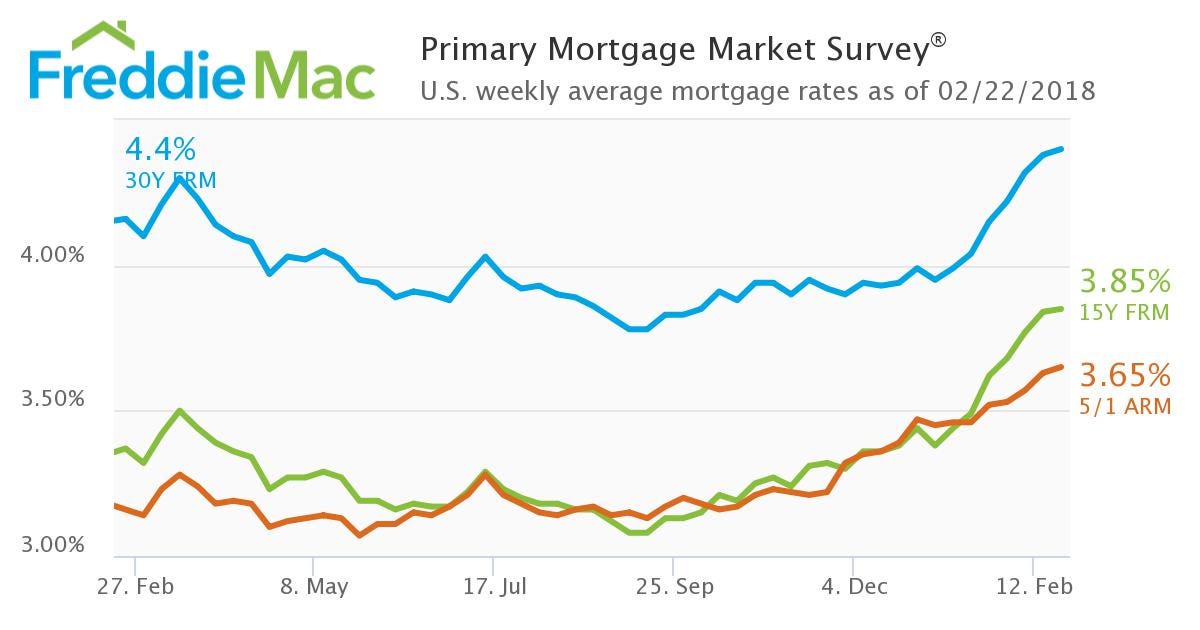

In its weekly Primary Mortgage Market Survey published on Feb. 15, mortgage giant Freddie Mac announced that the rate for a 30-year, fixed-rate mortgage reached its highest point since April of 2014. At 4.38 percent with 6/10 of a point in fees, the Feb. 15 rate was 43 basis points, or 9.8 percent, higher than the 3.95 percent rate with 6/10 of a point in fees reported in its Jan. 4 survey, and nearly the same as the 4.41 percent with 7/10 of a point in fees reported on April 4, 2014. A point is equal to one percent of the borrower’s loan amount.

The rates published in Freddie Mac’s surveys are a bit deceiving because the rate and fees are listed separately. The fees are akin to additional interest and serve to increase the lender’s yield. When the fees are not listed separately and are instead included in the rate, the rate is actually higher. A quick survey of a handful of Las Cruces-area lenders revealed that today’s 30-year fixed rate is averaging closer to 4.75 percent with zero points.

A three-quarters of a point difference may not appear to be significant, but it is. A borrower obtaining a $180,000 mortgage today at 4.75 percent would have to earn around $258 per month, or $3,096 more, per year than they would have had to earn last month when the rate was closer to 4 percent.

Fast-forward to a year from now when the Mortgage Bankers Association projects that rates will hit 5.3 percent, and our school teacher would have to earn $455 per month, or $5,460 annually, over the income she would have needed at 4 percent.

If there’s a message embedded in the numbers, it would be to purchase a home now before rising rates and home values make home buying more costly.

See you at closing!

Gary Sandler a full-time Realtor and president of Gary Sandler Inc., Realtors in Las Cruces. He can be reached at 575-642-2292 or Gary@GarySandler.com.

About author

-

-

About Author

Gary Sandler

-

© 2022 Gary Sandler - Website Developed by: Digital Solutions