-

Sep 22, 2017 Mortgage interest rates hit lows for the year

Sep 22, 2017 Mortgage interest rates hit lows for the yearPublished 22 September 2017

LAS CRUCES – After climbing steadily throughout the last quarter of 2016 and into the first quarter of this year, mortgage interest rates have reversed course and taken a turn for the better.

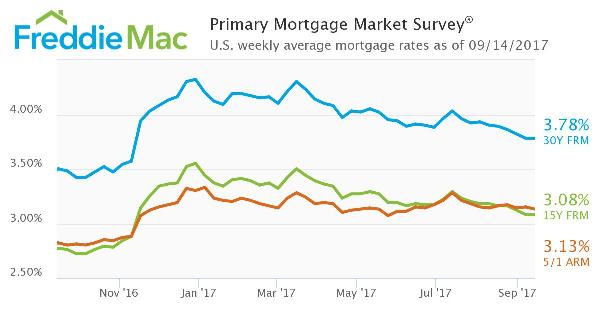

The rate on the popular 30-year fixed-rate mortgage (FRM) fell to 3.78 percent earlier this month, according to Freddie Mac’s Primary Mortgage Rate Survey published on Sept. 14. The rate was 3.5 percent during the same week last year. The rate hit a 2017 high of 4.32 percent in March before sinking to this month’s low.

The rate on the 15-year FRM also declined, falling to 3.08 percent from its high of 3.55 percent posted in January. The rate stood at 2.77 percent one year ago. In the case of both the 15- and 30-year loans, a fee equal to one-half percent of the loan amount is required to achieve the published rate.

Low mortgage rates provide an opportunity to refinance for some homeowners. Take, for example, a homeowner who took out a $150,000 mortgage in September of 2007, when the rate for a 30-year FRM was 6.38 percent. Assuming the $936.30 monthly principal and interest payments were made as scheduled, the balance today would be approximately $125,700.

Add to that balance refinance costs of, say, $3,000, and the homeowner would refinance in the neighborhood of $128,700 at today’s 30-year rate of 3.78 percent. On the upside, the monthly payment would drop by $338.08, to $598.22. On the downside, refinancing after 10 years essentially turns the original 30-year mortgage into a 40 years’ worth of mortgage payments and interest. This would be an okay strategy if the homeowner’s one and only goal is to lower the monthly payment, but it’s certainly the wrong way to go if the goal is to pay off the mortgage as soon as possible.

One way to avoid losing ground is to replace the original loan’s 20-year remaining balance with a 15-year FRM. Refinancing the $128,700 balance and new closings costs changes the equation significantly. In the short term, the monthly payment on the new mortgage at 3.08 percent would be $893.74, or $39.56 lower than the original payment. More importantly, the homeowner would instantly shave an additional five years off the mortgage term, and benefit from a trifecta of lower monthly payments, lower interest costs, and a shorter overall loan term.

The internet is replete with financial websites that offer refinance calculators, so give one a Google and see if you might be able to refinance your way into a more financially advantageous position.

See you at closing.

Gary Sandler is a full-time Realtor and president of Gary Sandler Inc., Realtors in Las Cruces. He can be reached at 575-642-2292 or Gary@GarySandler.com

About author

-

-

About Author

Gary Sandler

-

© 2022 Gary Sandler - Website Developed by: Digital Solutions