-

Sep 01, 2017 Credit scores are important – and valuable

Sep 01, 2017 Credit scores are important – and valuablePublished 1 September 2017

LAS CRUCES – According to a recent report from the financial website www.myfico.com, the average U.S. FICO score in 2007 was 689. FICO is an acronym for Fair Isaac Corporation, the folks who created the FICO score. The highlight of the report, however, was that the average score hit a milestone this April, rising for the first time to 700. Eleven points may not seem like much, but even a few extra points can make a world of difference when it comes to obtaining a mortgage.

Local lenders who make mortgage loans typically sell the majority of those loans to investors who operate in the secondary mortgage market. Those investors fall into three categories; government sponsored enterprises (GSEs), the U.S. government, and private investors. Freddie Mac and Fannie Mae are both GSEs and together own roughly 46 percent of all mortgages. Ginnie Mae, which is wholly owned by the U.S. government and purchases VA loans, is responsible for around another 15 percent. Private investors, such as pension funds, insurance companies, large banking institutions and securities dealers, purchase the remaining 39 percent.

It is those investors who set the minimum standards buyers must meet in order for their loan to be purchased. Local lenders usually have relationships with a number of investors so they are able to make loans to the broadest spectrum of buyers. It is for that very reason that buyers should shop around before choosing a lender. A case in point would be a buyer with a 630 credit score, who is told by lender “A” that they won’t qualify because the lender’s investor requires a minimum credit score of 640. That same buyer may easily qualify for the same loan at lender “B”, whose investor only requires a 620 minimum score.

The score itself is an indicator of risk. Some investors are risk-adverse and prefer to purchase loans made to borrowers who have high credit scores. High scores are usually indicative of good money management and low risk to the lender, mortgage insurance company and investor. The investor rewards their most creditworthy borrowers with low interest rates. The opposite is true for borrowers whose scores are low.

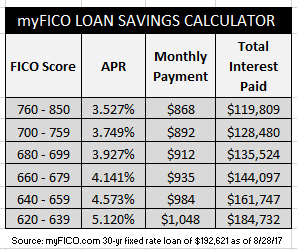

So, to what extent do credit scores affect the cost of money? In a word, bigly. According to the myFico loan cost calculator available to consumers at the website, the monthly principal and interest payment on a 30-year, fixed rate mortgage of $192,621 that was originated in New Mexico on August 28, 2017, ranges from a low of $868 to a high of $1,048. I chose to plug $192,621 into the calculator because it was the average sales price for the 1,192 new and existing homes, townhomes and condominiums sold in our area thru August 28 of this year, according to the Las Cruces Association of Realtors.

The rate is not the only component of a mortgage affected by credit scores. The difference in the amount of interest paid over the life of the loan also varies significantly. In our example, the total interest paid on a $192,621 loan made to a borrower with a score of between 760 and 850 would be $119,809 at 3.527 percent. Borrowers whose scores fall between 620 and 639 would pay $184,732 at 5.120 percent. By my fuzzy math, that 120 point difference is worth $64,923 over the 30-year life of the loan.

Whether purchasing a home or a vehicle, obtaining just about any type of insurance or applying for credit, it pays to know what’s in your credit files. A small error on a report can easily result in higher costs down the line. Checking files is free and easy to do. Everyone in the U.S. is entitled to a free annual look into their credit files at each of the three credit bureaus; Experian, Equifax and Transunion. Free access can be gained by logging on to www.annualcreditreport.com. The site is the only portal authorized by the U.S. government to allow free access to reports. Errors can be disputed online or by calling toll free to 877-322-8228. Requests can also made by writing to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

In the end, you are the only person on the planet who’s in charge of your credit scores. If you haven’t checked your files recently, it may be a good idea to do so now. Tutorials on how to take charge of your credit can be found all over the internet. The two I reference most often are www.myfico.com and www.creditkarma.com.

See you at closing.

Gary Sandler is a full-time Realtor and owner of Gary Sandler Inc., Realtors in Las Cruces. Gary can be reached at 575-642-2292 or Gary@GarySandler.com.

About author

-

-

About Author

Gary Sandler

-

© 2022 Gary Sandler - Website Developed by: Digital Solutions